For a physical asset held on behalf of a country's citizens primarily for use in extremis, central bank reporting on gold holdings is woeful. It is impossible for a country's citizens to determine if their central bank is appropriately managing their (as in citizen's) gold such that it can perform its "last resort" function, if necessary, without knowing:

a) the amount of physical gold held under its control and ownership versus how much has been leased (physically, not book)

b) the amount of physical gold held domestically versus offshore

I would argue that gold has a higher standard of disclosure compared to a central bank's fiat activities because if lost, say by the bankruptcy of a lease counterparty, physical gold cannot be printed out of thin air.

Now you may argue that I am being unrealistic, pointing to GATA's freedom of information lawsuit against the US Federal Reserve, or the IMF's 1999 weakening of central bank gold reporting requirements, as examples of central bank opacity. I agree that it is a difficult ask, but in both these cases either the detail sought, or the reporting frequency, opens up lines of arguments that can be used to muddy the waters and give plausible grounds for refusal.

I would argue that one does not deal with bureaucrats as one would in a commercial negotiation, where you go in with your highest (or lowest, if buying) offer, as that just opens up many points for refusal. It is better to go in with your strongest argued case, which will often not be exactly what you want, because it give much less wriggle room, and thus the best chance of success. Secondly, bureaucrats can have an arse covering herd mentality, so appeals to precedent are always useful as no bureaucrat wants to strike out on their own lest they get it wrong.

Given the above, I would propose that the best way to approach central bank gold reporting is to simply argue that central banks follow the accounting standards, that normal commercial organisations do to, when producing their annual reports.

Simple and reasonable. It is also difficult to argue against as central banks, via their oversight and regulation of the financial system, impose those accounting standards on others. It is also hard to argue against it on the basis that it would be market sensitive, as it is only being disclosed once a year and many months after the balance date of the annual report. As a result, one could interpret a refusal to do so as hypocrisy and an indication of something to hide.

You may wonder if this will achieve anything with respect to physical versus leased gold. By way of example, I offer the Reserve Bank of Australia (RBA), which also provides you with a precedent. The RBA has, at least since 1998, been reporting physical gold, gold leases, the duration and risk profile of those leases, and average lease rates, all to accord with Australian Accounting Standards.

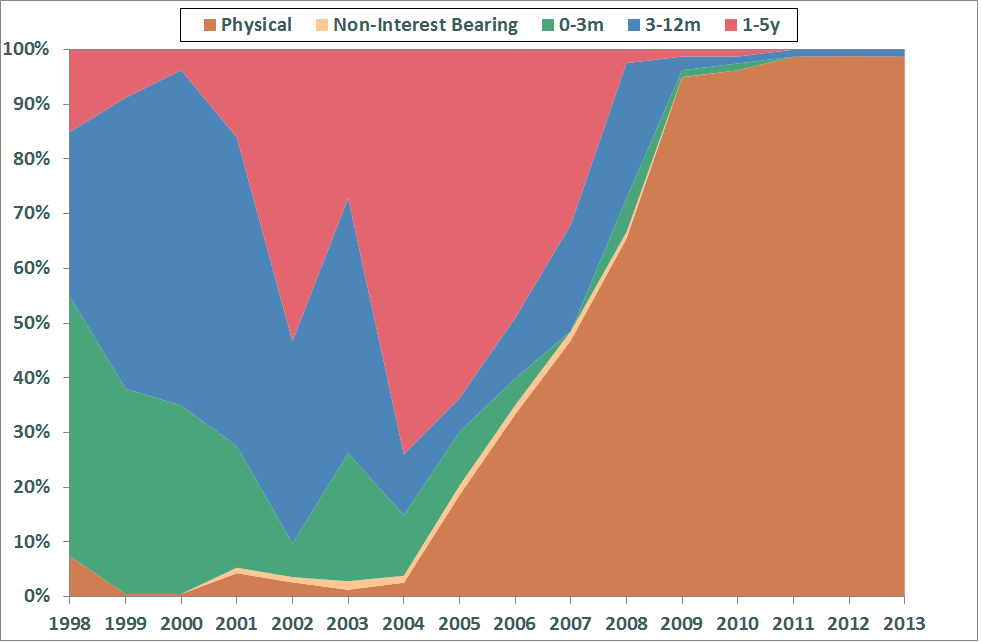

For example, an analysis of the RBA annual reports allows us to produce the chart below, which shows how much of Australia's meagre 80 tonnes was held as physical and how much was leased out for which terms.

It is clear that the RBA started winding back its leasing after 2004, due I would argue, to the fact that lease rates by that stage had moved below 1% (and subsequently continued to fall), providing a poor risk/return tradeoff. We can also produce a breakdown of the credit rating of who the gold was leased to.

So we can tell from the above that the RBA is now only leasing 1 tonne of gold for a duration of between 3-12 months to an AAA rated counterparty. Such information, if provided by all central banks, would provide their citizens with the ability to assess how prudently their gold was being managed. It would also provide valuable information to the gold market in general.

So if it is good enough for the Reserve Bank of Australia to report this level of detail with respect of its gold reserves, I think it is fair to say it should be good enough for other central banks.

Technical Note: In point a) I referred to "leased (physically, not book)". The reason is that there is a difference, in terms of whether gold is at risk of counterparty failure, whether a lease involved actual physical shipment to the borrower, or whether it was just leased by way of a book entry with the physical gold remaining in the possession of the central bank.

Thus when looking at gold reserves in terms of its last resort use, if gold is leased by book entry then it is arguable that there is no risk as, in case of a war for example, a central bank can just extinguish the paper claim by the counterparty and retain the gold.

The extent to which central banks have lent gold physically or only via book entry to bullion banks and the different implications of those two methods for the stability of the fractional reserve bullion banking system and its run-proofness is another topic altogether, and one I can cover in another post if anyone is interested (stupid question, of course you do).

If I read it clearly, in the beginning you say CB's should be trusted to keep the accurate records when the bullion is in their possession but in the end you say they can abrogate that trust(?) in case of other counter-party's failure to honour the commitment. Isn't trust at the core of this entire system whether it is paper failure or physical failure? At that stage the whole system would have broken down anyway, so why should anyone impose any faith in these CB's in the first place? May be I have misread you.

ReplyDeleteYes, I am very much looking forward to your other post :-)

I'm also eagerly awaiting your next posting on central bank gold.

ReplyDeleteSpecifically, the Fed released an audit, re:gold held on September 30 2012. Was the audit of any value ?

If the Aussie bank is so transparent, it should be no problem to provide identities of all counter-parties to all swaps, all correspondence connected to such swaps and all official inter-bank documents from all central banks involved in decision making, stating reasons and results of all swaps, along with all white papers, emails, notes, and both official and unofficial data, and all written results of all audits, including notes and methods of audits, identities of auditors, including bar numbers and origins of all gold involved in such swaps. Does the Aussie mint publish contemporary bar numbers of current stocks? Is that what you mean by transparency? If not, perhaps we can get them from Wikileaks or Ed Snowden.

ReplyDeleteAnd what about the bullion stored by the Perth Mint for its customers, perhaps five billion dollars by now? How gracious of the Perth Mint to store it for their customers with no fees (at least that is how it was a few years ago when I asked) – paying all those wages, storage costs, dog food, etc for free. Such benevolence, or does the Perth Mint just have an IOU bullion certificate at the London Bullion Market and thereby treat their customers like a bunch of patsies? Transparency, you are kidding me right?

ReplyDeleteBron, the idea that central banks i.e. governments, hold gold on behalf of their citizens is naive at best.

ReplyDeleteWhat the central bank does with ITS gold is none of your business.

I have to agree with Chris from Baton Rouge. In any case, central bank obligations cannot possibly compete with the highest quality if things were transparent. Who says the counterparty is AAA? The RBA?

further to what Justin & Chris said, if the banks cannot give is the actual names of the persons involved in each swap, etc, and their photos, date of birth, current home address, etc, to prove that these folks are genuine persons, then this is clearly NOT transparent. We demand transparency. Anything less than what I have asked above is clearly not transparent.

ReplyDelete"anon" says the bullion is stored for free. Wow what is he smoking, becuase it must be good stuff. Any ill-informed person knows full well there is a range of different fees charged for bullion storage at Perth Mint, and there always has been. What the hell is he smoking?

What is he smoking? As I said I enquired a few years ago and when I asked where Perth Mint stored the bullion he vaguely said ‘some in Perth, some in New York and some in London’ and when I asked why he didn’t charge storage fees he said ‘yes, we are thinking of bringing in storage fees.’ So if I have a bar in storage with the Perth Mint they will photograph the serial number and tell me which box it is in will they? Will they do a video tour of the vaults once a week to show all five billion dollars of stored bullion for their customers, available on their website? Or do they just tap the ‘guaranteed by the State of West Australia’ sign and say trust us? I am not saying that the Mint hasn’t tidied its act up but a few years ago it was disgraceful.

ReplyDeletewill they do a video tour once a week... ha ha... yes maybe they will, once every bank & insurance company world-wide starts doing the same, to prove that your money is truly safe.

ReplyDeletethe Perth Mint cannot have been "disgraceful" as you put it, seeing as you imply that some competitors must have been "graceful", and that, as we both know is a complete falsehood.

No-one measures up to the Perth Mint, certainly not ANYONE based in either Canada or the US. They are all big fraudsters over there, skilled at brain washing their "customers" or US "dupes".

Sometimes these guys appear on podcasts, in addition to writing in their ignorant blogs, and it is clear that they do not have the faintest clue about precious metals.

You're being stupid Mr Anon, whoever the fuck you are. Go hook up with Mr Advocado why don't you.

ReplyDeleteI would love it if Perth Mint was the straightest shooter in town in the metals market, so surely a video tour is not an unreasonable suggestion to show the five billion dollars or so in stored metal for their customers? It even sounds like a great business promotion option. I am sure the punters would be beating down their door to offer the Mint their additional business if the Mint could show their stored and numbered bullion listed to customers’ accounts? Not such an outrageous proposition is it?

ReplyDeleteTanks for this, Bron

ReplyDeleteThanks for this, Bron. I think the RBA reporting standards should be implemented by all CBs with some expansion of the detail regarding the gold leased out aimed at enabling gold market analysts to determine how much physical and leased gold has hit the physical and paper gold markets from the CBs over a specific period. This will require that each CB splits its total gold holding into (i) physically held and unencumbered (ii) leased and physically delivered to the lessee and (iii) leased but not physically delivered.

ReplyDeleteIf one has this data at two data points one can calculate (a) how much physical gold the CB has bought or sold; (b) how much physical gold found its way to the physical market through leasing (c) how much paper gold found its way to the paper gold market (d) the gold that the lessees will have to buy back to redeem their leases at the CBs.

Thanks Bron. Agree completely, especially with the importance of the distinction between leased physical still-in-possession and the other, which is really a sale dressed up as lease.

ReplyDeleteA quibble: looking at the charts, your line "So we can tell from the above that the RBA is now only leasing 1 tonne of gold for a duration of between 3-12 months to an AAA rated counterparty." looks like the credit rating should read "Other."

Bron, it would be great for countries to come clean on the gold swaps and liens. However, the USA has a huge number of banksters, and they are running the show in New York. If the America openly and honestly tells the truth, it would be forced to admit that it has no gold left.

ReplyDeleteWhy do you think J.P. Morgan engineered the crash in gold prices last April? Why do you think they've followed up on that by taking 92% of all deliveries of gold in New York? JPM is trying pay back some gold previously loaned to it, by the NY Fed so that the Fed can hide the fact that it used German gold in its monetary manipulations.

JPM wanted to buy physical gold on the cheap, and because the mining executives are so stupid as to base sales on the paper price, they've succeeded. With a paper money subsidy from the NY Fed, to cover the performance bonds, JPM managed to create a nice price for itself. A huge amount of the gold it has accumulated in this process just got shipped out of its COMEX warehouse. Guess where it is heading? That's right... the NY Fed. Guess why? That's right, because the Fed vault is entirely empty. That is the reason that only 5 tons of gold, out of 346 tons, has already been delivered to Germany by the USA in an entire year.

Bottom line, the USA CANNOT come clean on the "swaps" because, if it does, the game is over for its debt sales and for the US dollar.

ReplyDeleteLet me tell you all a tale about some of my dealings with the Perth Mint.

ReplyDeleteFor the record, I hold both allocated and unallocated metal there.

Anyone who has read their documents or has followed Bron's 'Gold Chat' for any length of time understands that their unallocated accounts are backed by real metal in their production processes or unsold inventory.

As far as their allocated storage is concerned, I have paid storage fees since I first opened my accounts around ten years ago.

A few years ago, someone who I thought could be better informed than I was told me in strong terms that the allocated metal which I thought was in segregated storage 'was just in one big pile along with 'all the other 'allocated stuff' in different accounts.

So, I phoned the Perth Mint and said that I was thinking of having them send me one of my allocated 1000 oz bars of silver, for which bar numbers and weights had been provided on account statements.

The guy on the other end of the line replied 'Any particular one of them, Sir?'

I believe that any holder of allocated metal at the Perth Mint can, with notice in advance, request to see and hold their bars or coins, and can even write on them with a marker pen.

If you doubt this, why don't you try to request it, and see what happens?

Anon #1

ReplyDeleteI think you can trust the reported figures/annual reports of most CBs. Just because in a monetary system reset or war etc the chance they will settle metal accounts in cash doesn't mean we can trust them now, at least in their figures.

Anon #2

By memory that audit was not a full physical stocktake, more a sampling and also checking of seals. I would need to look into that in more detail.

Chris

If you have a look at the RBA's website re FOIs, you will see they do provide internal notes etc, certainly seems to me a lot more open than the pulling teeth that GATA went through with the Fed. However, no CB or any Govt department will reveal commercial counterparty details given privacy concerns. If that wasn't the case, then your personal tax info etc would also be able to be FOIed and I'm assuming you wouldn't want that. Do unto others ...

Anon #3

You are right to be suspicious of free storage, but only when it comes from a bank as they have no use for physical, so could only offer free storage if they lent it out. In the case of the Perth Mint, the $2.5b or so of unallocated is backed by physical working inventories - how do you think as a refinery and mint we can operate without any gold in the factory. This is all explained on our website and I've covered it here many times, eg http://goldchat.blogspot.com.au/2008/12/mint-has-no-gold-again.html

Justin

“ITS gold” I get your point, but really that should be considered by CBs to be OUR gold. I think the rating would be as per S&P or other ratings agency, it wouldn’t just be decision by the RBA.

Anon #5

That conversation you had with our staff member does not sound correct. If you were asking where the gold is that backs the unallocated, most of it is in Perth, but we also do have smaller amounts in warehouses around the world which represent metal in transit to our distributors. We do not store allocated outside of Perth.

If you have allocated you, or someone you appoint, can come in and photograph your bar or better still I would recommend getting a marker pen and initialling the bar or some mark on it so you can be sure you get the same bar back again, if you are so inclined.

We cannot do a video tour of the vaults due to security concerns, that would give criminals far too much information. In any case, with unallocated the gold backing it is in various semi fabricated forms so even a video tour of the entire factory would not allow you to determine how much gold we have as you couldn’t work out the weight just from visual inspection.

We do a fully physical stocktake every quarter and that takes a couple days and involves an entire shutdown of the factory. I’m not sure what else we can do.

Anon #7

I am not sure what you mean by “if the Mint could show their stored and numbered bullion listed to customers’ accounts”? This is what allocated and pool allocated customers already get. With unallocated, as explained, a bar list is not possible as the gold and silver is all in semi fabricated forms, and most of the stuff that is fabricated is in coin form, which has no bar numbers. I think you and the other Anons do not understand that Perth Mint unallocated is not some sort of pooled physical like an ETF or GoldMoney or Bullion Vault – our unallocated is backed by our working inventories.

Baruch

Agreed, but lets just try and get them to apply basic accounting reporting standards first!

Anon #8

Some of the physically delivered leases would be used in jewellery manufacturers and other industrial uses, but that would be minor so, yes most of the leased has been sold. The credit rating is definitely AAA on that 1 tonne lease, maybe the charts don’t show that clearly, but that is what is in the data behind them.

Great article.

ReplyDeleteI think all Central Banks should not be allowed to lend or lease gold in any form.

They should also disclose how much they have each month.

That way we may start to get some trust back into them and the markets.

Good to hear that the allocated bullion at Perth Mint is legitimate with numbered bars, marked if required, but what of the unallocated bullion? Perth Mint takes the money against the flow of bullion within the production process but are there limits to this leverage? Is Perth Mint selling ‘deep storage’ bullion with the ore still in the rocks in Australia – if so then it is surely running a futures racket which deflects natural demand into future production to control prices? It is like the classic line of ‘hundreds of barramundi caught, thousands sold.’ Is the Perth Mint acting like a barramundi wholesaler who is selling generations of barramundi which have yet to be born? Does Perth Mint list their daily flow of ounces currently in the production process against ounces of bullion which are unallocated so that the public could gauge the flows of demand and production?

ReplyDeleteAnon,

ReplyDeleteUnallocated is backed 100% by the stock of the Mint, but that stock "flows" - as gold is sold we buy replacement gold, so the stock is maintained. There is no leverage.

Maybe this explanation will help http://www.perthmintbullion.com/Blog/Blog/11-02-28/Understanding_Unallocated.aspx Some have told me it is actually more confusing. Let me know if this helps.

Ok Bron, thanks, that makes sense with the unallocated bullion sales. It is easy to be doubted when you swim in a pool of swindlers – such as the Morgan Stanley fines for not storing gold for their customers and then claiming as a defense that it was industry standard practice.

ReplyDeleteCan you also tell me why Australia has so little gold at the Reserve Bank, about 70 tons I think, with only about 70 kilos stored at the Bank (I read this somewhere) with the rest gone into the darkness of the LBMA, when Australia is the second largest gold producer in the world? What strange monetary philosophy goes on within those central bank corridors and has the Perth Mint tried to increase the awareness in precious metals within the Reserve Bank?

I believe the reasoning was that as a gold producer Australia could always get gold from its production flow so didn't need a large stock.

ReplyDeleteThe problem with this is that in a war or similar the mine can only produce at a certain rate and that may not be enough flow to trade for stuff you need ASAP.

Perth Mint as a government entity cannot get involved in advocating for policy positions, of which how much gold reserves is one.

So, if the Perth Mint always has 100% allocated and unallocated reserves then if I convert my unallocated to allocated at the Perth Mint it should only take, say, a maximum of six weeks to deliver, assuming that it takes about six weeks from the time the silver raw product enters the Perth Mint ‘pipelines’ to the time it is converted into bullion products? Would this be a fair assumption?

ReplyDeleteThe Depository contact say unallocated to allocated conversions are 2 weeks.

ReplyDeleteIf everyone turned up and wanted all the unallocated gold then it would take longer. How long depends on what sort of product they want as our production capacities are different for different products.

Not sure where you get the six weeks from. It would be in the weeks rather than months and months.

The ‘six weeks’ was just a guess, two weeks is fine! And with China reputedly now buying up the world’s annual gold production, the ETF’s being stripped, the mines on the verge of bankruptcy with the low price, then how is the Perth Mint planning to ensure the continuity of supply, especially as it seems that there are moves to buy ‘gold at source’ rather than through the traditional supply lines?

ReplyDeleteWe are not seeing any threat to our refining sources of gold.

ReplyDelete