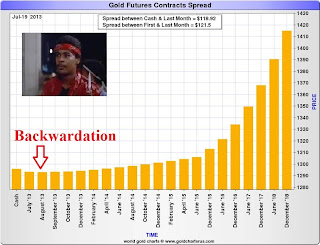

Shortodile Golddee is threatened by a goldbug with backwardation

Sue Shortton: Shortodile Golddee, give him your short positions.

Shortodile Golddee: What for?

Sue Shortton: He's got backwardation.

Shortodile Golddee: [chuckling] That's not backwardation. [draws a oil chart] That's backwardation.

(apologies to the screenwriters and thanks to Nick for the charts)

Interesting thoughts Bron.

ReplyDeleteBut just to take the other side here, why do you think that this state has not been in this situation since 2008? And only a few times in the past decade?

Even though the long-term charts for gold dont show backwardation, the fact that this is an extroardinary rare event should signify something...

I'm curious on what your opinion is on why, in a market that rarely shows backwardation in the short-term, there is now bakwardation on the short end of the market?

Thanks!

The gold chart shows a long term uptrend in gold. The oil chart shows a long term downtrend in oil.It does not show backwardation. It simply shows that buyers believe that the price of oil will drop over time.

ReplyDeleteGold is different. It shows a long term uptrend. However, in the short term the prices are lower. This is true backwardation. It defies the trend, and therefore indicates fear of near term gold supply failure or even force majeure. Another backwardation indicator is that the gold lease rate is higher than the Libor rate.

I get the point, but isn't there a difference between oil, which is consumed, and gold which is not consumed?

ReplyDeleteI don't quite understand why you are comparing a rapidly consumed commodity like oil and for which there aren't any large above-ground supplies to gold for which there is an above-ground stockpile of app. 170,000 tons and not consumed. Gold is a currency, not a commodity and is traded on the foreign exchange markets to the tune of $200 billion daily. Backwardation of any sort should not normally occur in the gold market because of the available large above-ground supplies. The fact that gold backwardation is in fact occuring is highly significant. The now twelve days of negative GOFO rates suggest extreme tightness in the physical market in London. I find it somewhat strange that you are trying to downplay this.

ReplyDeleteObviously you don't understand gold.

ReplyDeleteGold should never be in backwardation. The stock to flow ratio is so high, that any backwardation event lasting more than a couple of days indicates severe stress in the monetary system. Backwardation in gold indicates a market perception that future delivery is questionable - this should never be the case for gold because the stock is so great and the commodity is non perishable and supply interruptions are insignificant in respect of the total stock. Oil is a completely different animal, where the available stock is counted in days. There are thousands of tonnes of gold that are not consumed; they just sit there gathering dust as a store of wealth.

Your "analysis" is lazy at best.

@Integrity. Your understanding of backwardation is incorrect.

ReplyDeleteWe should not confuse the relationship between near dated and far dated futures prices - such as "contango" (gold)and "backwardation" (oil) - with the the relationship between physical and futures prices -

"premiums" and "discounts".

I take it Bron that you are not seeing any interesting developments in the 'spread' between physical, allocated & unallocated gold?

ReplyDelete@ Anonymous

ReplyDeleteIt is my experience that Bron understands gold better than 99% of those who comment on the subject on the blogosphere.

One person who demonstrably does NOT understand GOFO and gold backwardation is Jim Sinclair. Here is a recent post of his:

Posted July 23rd, 2013 at 11:06 AM (CST) by Jim Sinclair & filed under In The News.

Dear CIGAs,

GOFO = Gold forward rates, the difference between cash gold and future gold.

Backwardation = Negative GOFO

Negative GOFO = When the nearby future gold price exceeds the spot future gold price.

His three definitions are bizarrely confused and just flat WRONG!

I trust that Bron will not think that I am trying to divert traffic from his site if I point you to

http://screwtapefiles.blogspot.com.au/2013/07/is-negative-gofo-significant.html#more, which now has an addenda with more of Nick Laird's charts (the minor near term backwardation is gone as of Tuesday), and then to the comments that follow which include my critique of Sinclair's nonsense.

I think Jim Sinclair understands a hell of a lot more about gold than some guy who works at the Perth mint.

ReplyDeleteIs Bron the guy at the Perth Mint who stands by the front door?

ReplyDelete